The Debt Funnel: How U.S. Courts are Filtering Venezuela's Crisis

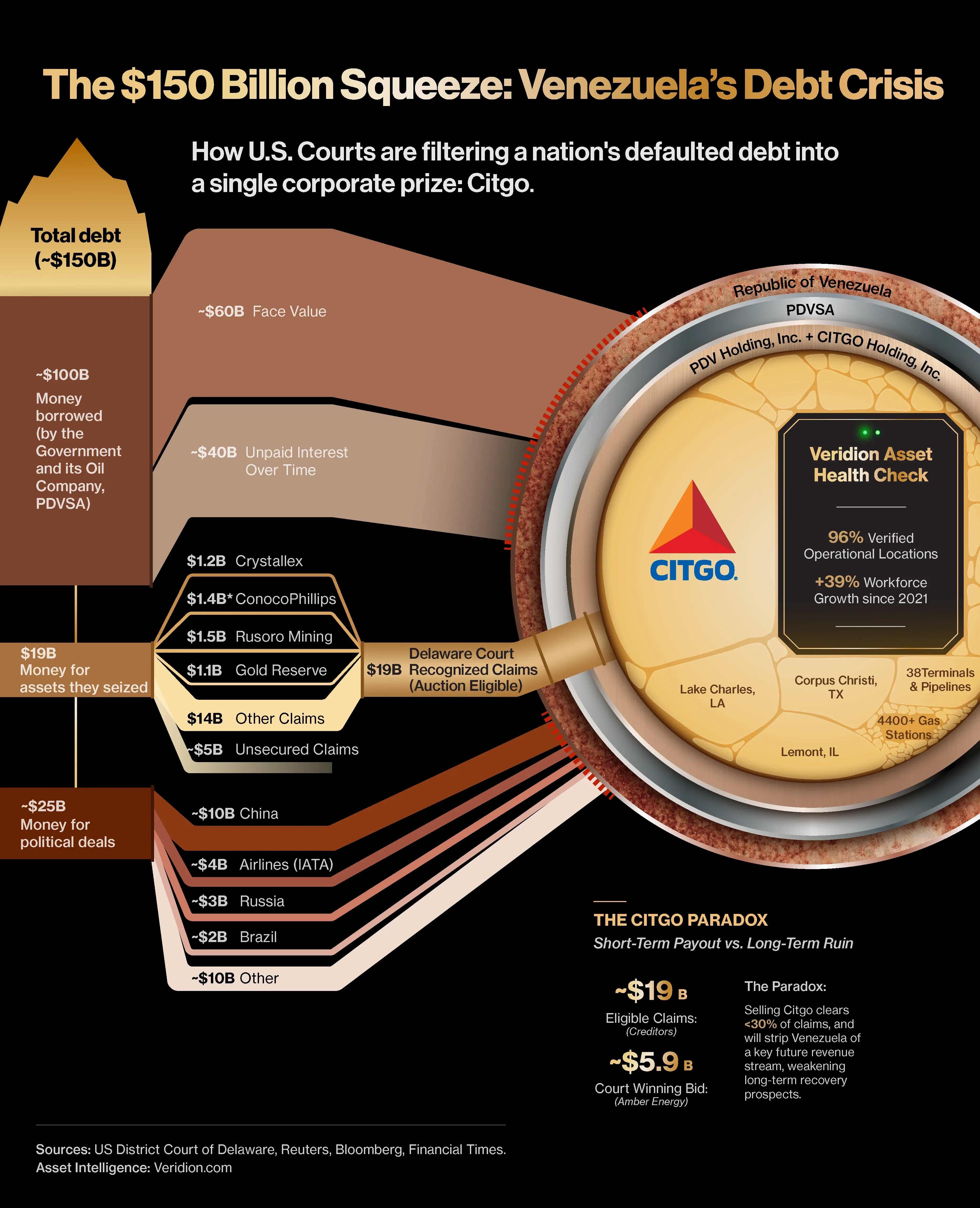

This infographic visualizes the massive financial pressure meeting a narrow legal keyhole. It breaks down Venezuela's overwhelming $150 billion debt crisis into the specific streams of money vying for a single corporate prize: Citgo.

Core conflict

While the total debt includes everything from sovereign bonds to political loans from China and Russia, U.S. courts have filtered this down to a specific "auction-eligible" slice of just $19 billion. The core conflict is visualized in the "choke point": billions in sovereign debt are blocked at the outer wall, while only a select group of arbitration awards successfully penetrate the corporate veil to target the asset.

But what makes Citgo worth fighting for?

Beneath the complex legal shielding, we checked the operational reality of the prize itself. Far from a decaying asset, the data indicates a company in active growth mode.

An "Asset Health Check" of Citgo’s physical footprint confirms that

- 96% of its locations are verified operational,

- while the company has actually expanded its human capital with 39% workforce growth since 2021.

This creates a striking contrast: a distressed financial wrapper hiding a healthy industrial core of refineries, terminals, and over 4,000 gas stations.

The Paradox

The winning bid of ~$5.9 billion clears less than 30% of even the eligible claims. This result essentially strips Venezuela of a vital, growing economic engine while leaving the vast majority of its creditors and its national debt unpaid.