Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Zoom Video Communications, the company that rose to fame during the early days of the pandemic, ended fiscal 2024 on a strong note, reporting results for its fourth fiscal quarter ended January 31 that beat analyst expectations on the top and bottom line. Adjusted earnings per share were up 16 percent year-over-year while total revenue and enterprise revenue increased 3 and 5 percent, respectively. That’s still a far cry from the growth figures Zoom posted during the pandemic, when the company saw its revenue grow manifold in a matter of months. The end of working-from-home requirements and subsequent return to offices as well as stiff competition from Microsoft Teams, Cisco’s Webex and Salesforce’s Slack have brought the former pandemic high-flyer back to earth.

Zoom isn’t the only pandemic winner struggling to maintain its momentum in the post-pandemic world, however. Other companies that soared under the special circumstances created by Covid-19 have also come crashing down over the past two years, as normal life gradually returned. Home fitness company Peloton and DIY marketplace Etsy, which profited from a large volume of mask sales on its platform during the pandemic, are two such examples, along with vaccine maker Moderna and DocuSign, a company that allows companies to manage agreements electronically.

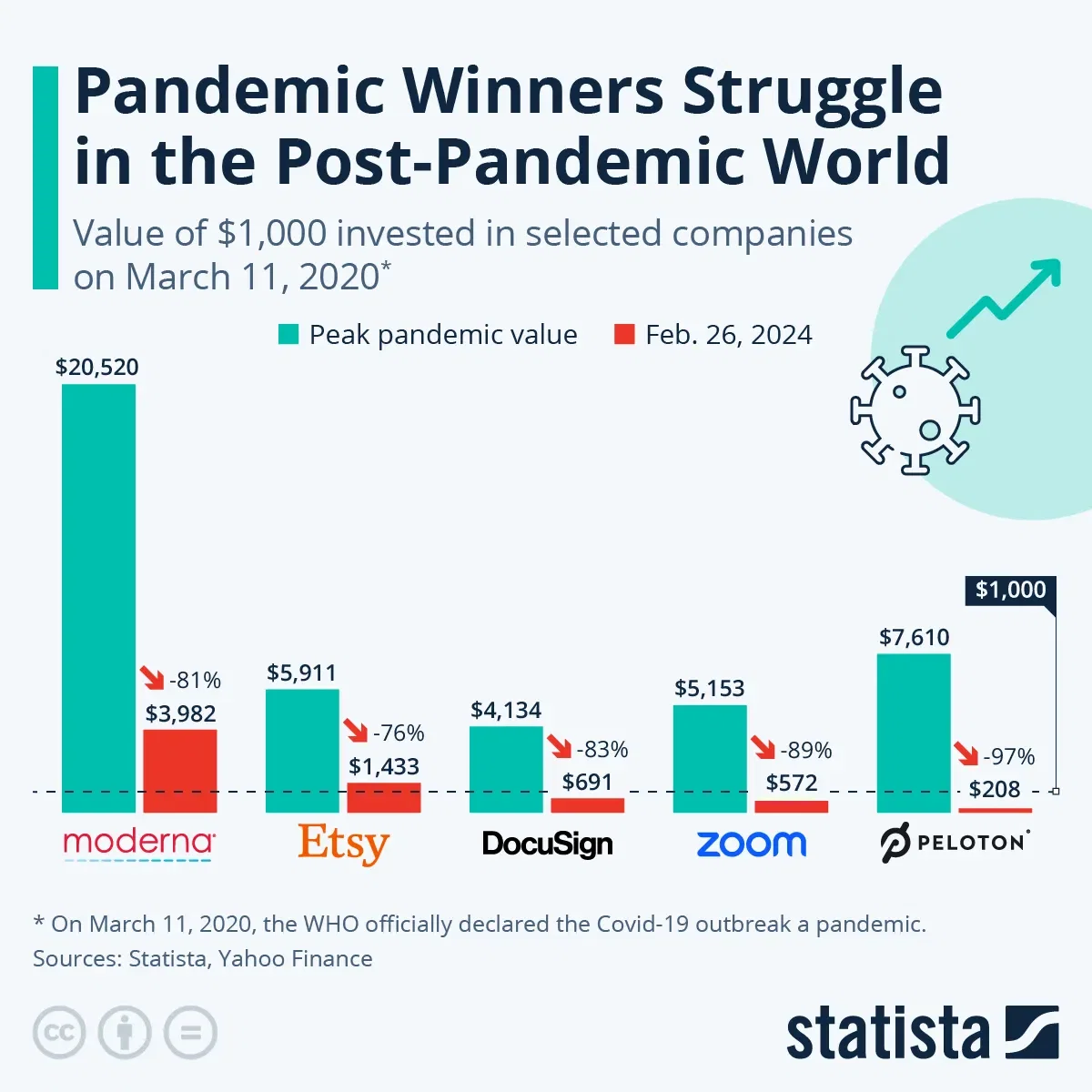

As the following chart shows, all of these companies saw their stock price surge during the Covid crisis, but all of them have fallen more than 75 percent from their peak pandemic valuation. $1,000 invested in Moderna shares on March 11, 2020, the day the WHO declared the Covid-19 outbreak a pandemic, would have appreciated to more than $20,000 by August 2021 and would still be worth almost $4,000 today. Investors who bought shares of DocuSign, Zoom or Peloton at the onset of the pandemic and held on to them until now are suffering from a severe pandemic hangover, though, as the shares of these companies are now worth (significantly) less than they were in March 2020.