Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Michael Burry's $912 million short will likely be profitable in the next 2-3 years, not because Palantir Technologies fails, but because multiple compression is inevitable. The company could hit every revenue target, and the stock could still decline 30-40% if valuation multiples normalize.

Palantir is executing a masterclass in business model transformation while simultaneously trading at valuations that demand near-perfection for the next 5-7 years.

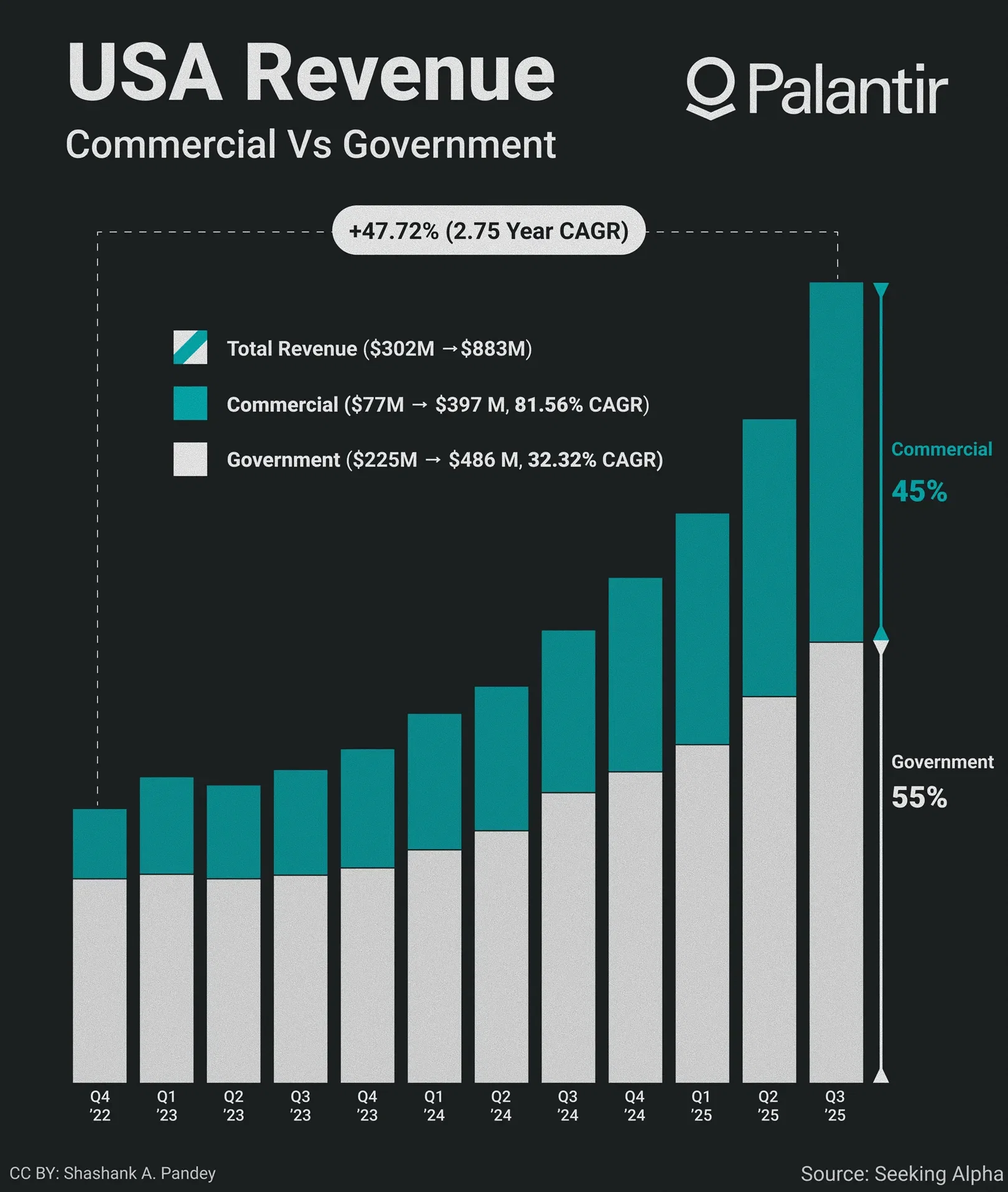

The revenue mix data from Earnings reveals the real story that matters:

- Government: 32.32% CAGR, now $486M (55% of revenue)

- Commercial: 81.56% CAGR, now $397M (45% of revenue)

Inflection: By Q4 2025, commercial is projected to hit 50% of total revenue

Palantir is escaping a cyclical defense contractor category and becoming an enterprise AI platform play. That's genuinely valuable.

Burry's short isn't simply "AI valuations are too high." His actual thesis is far more concerning. He's identified what he calls circular financing dynamics that may not survive sustained examination.

The Circular Financing Pattern:

- Tech giants invest heavily in AI infrastructure, announcing massive capex spend

- They buy chips from Nvidia -> They deploy AI services, using the infrastructure they just built

- They call this "AI revenue." This revenue becomes the justification for MORE infrastructure spending

- Valuations inflate on the story, because growth appears exponential

But the revenue is partially self-financed: The loop doesn't anchor to end-user demand; it anchors to balance sheet availability

Why This Matters for Palantir Specifically:

Burry's core observation is brutally simple: Palantir's valuations don't match how world-class businesses actually scale. For Palantir to justify current multiples, it needs to:

- Grow commercial revenue at 60-70% annually through 2030

- Maintain government revenue growth at 40%+ simultaneously

- Keep net margins at 35-40% while scaling distribution to mid-market

- Face no meaningful competitive pressure

At the same time, Burry's valuation critique is mathematically sound, Palantir has genuinely proven something remarkable. It's an operationally disciplined company that invests in growth while maintaining fortress economics. Most SaaS companies at this scale operate at 5-15% net margins. Palantir is at 40%.

Palantir's business is demonstrably excellent. But the market has priced in a perfect 30-year compounding scenario right now. Even a very good outcome is a loss for current investors.

Palantir proved you can build a $4B+ data/AI company outside Silicon Valley, with 40% net margins, without burning investor capital. That's the lesson. Whether the stock at 200x forward earnings is a buy is a different question. Burry isn't shorting Palantir's business. He's shorting its valuation. Both are defensible positions.