Where Data Tells the Story

© Voronoi 2025. All rights reserved.

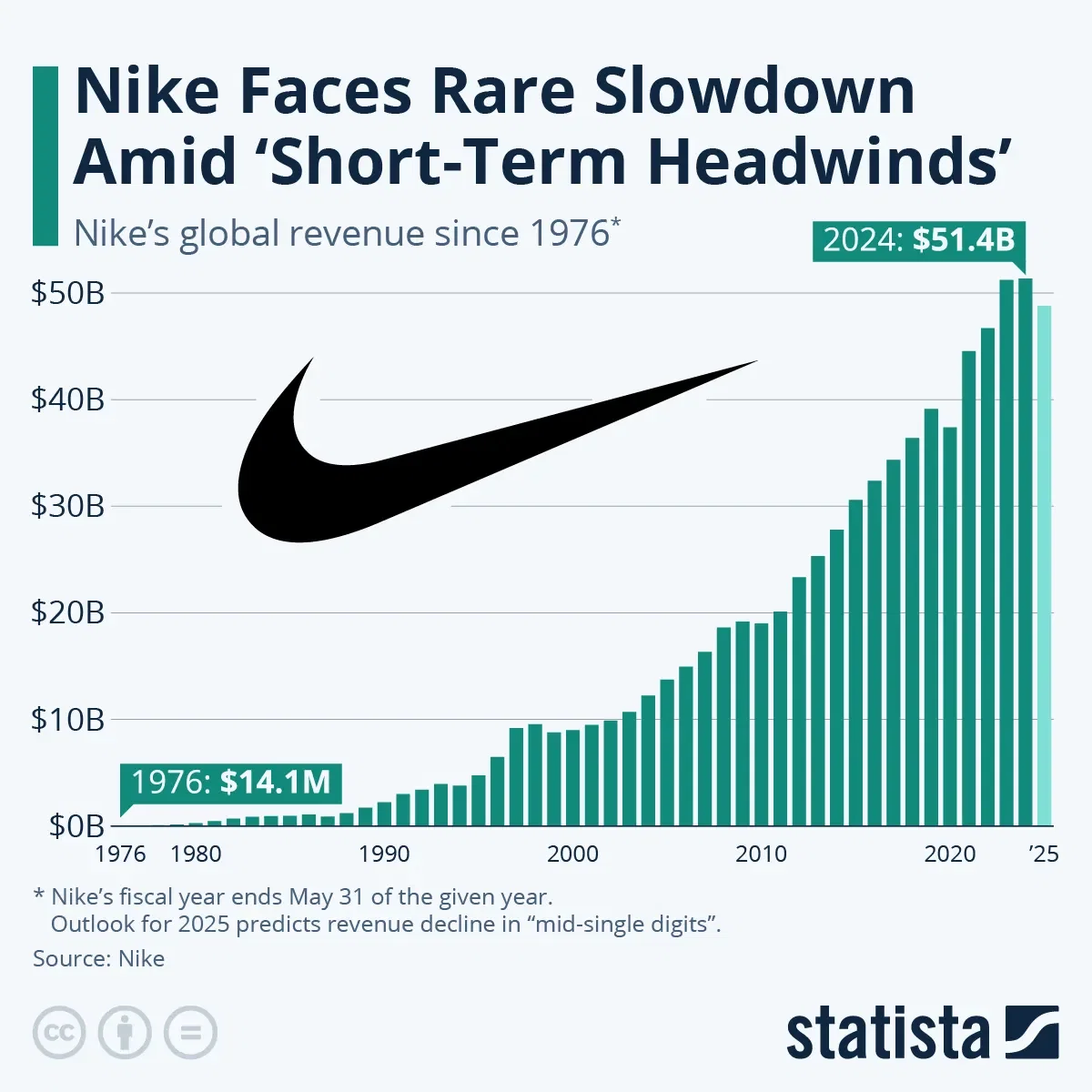

Shares of American sportswear giant Nike slid more than 15 percent on Friday morning, after the company reported disappointing earnings and an even more disappointing outlook for the near future. The world’s largest maker of performance and lifestyle-oriented athletic footwear and apparel reported revenue of $51.4 billion for the fiscal year ended May 31, which is basically unchanged from $51.2 billion the previous year. For a company that touts itself “a growth company” on its investor website, zero percent growth is of course not good enough, but what was even more disconcerting for Nike’s shareholders was its outlook for fiscal 2025. For the current fiscal year that ends May 31, 2025, Nike expects revenue to decline by the “mid-single-digits” with an even more pronounced sales decline in the first half of the year.

Given Nike’s difficult past few months – the company’s stock was down 13 percent this year even before Friday’s tumble, as it had been late to the retro runner/sneaker trend embraced by companies like New Balance and Adidas – investors will be hard-pressed to see the positives in Thursday’s results. Despite the negative short-term outlook, the company’s leadership tried to exude confidence. "This summer we will cut through the clutter to create powerful energy for the Nike brand," John Donahoe, the company’s CEO said looking ahead at the Paris Olympics. “In the end, we’re taking our challenges head-on, and we’re regaining our edge. Thanks to the heart and hustle of our global team, we are aggressively asserting the future of Nike. With passion, clarity and grit, we’re driving this business forward. We’re excited about the opportunity in front of us, and we’re eager to prove what Nike can do.”

As our chart shows, there have been very few setbacks in Nike’s impressive growth story. Since its founding days in the early 1970s until today, the company has never seen two consecutive years of declining sales. Time will tell if that streaks continues.