Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Shareholders of public companies often receive the right to vote on corporate policies like issuing dividends or initiating mergers.

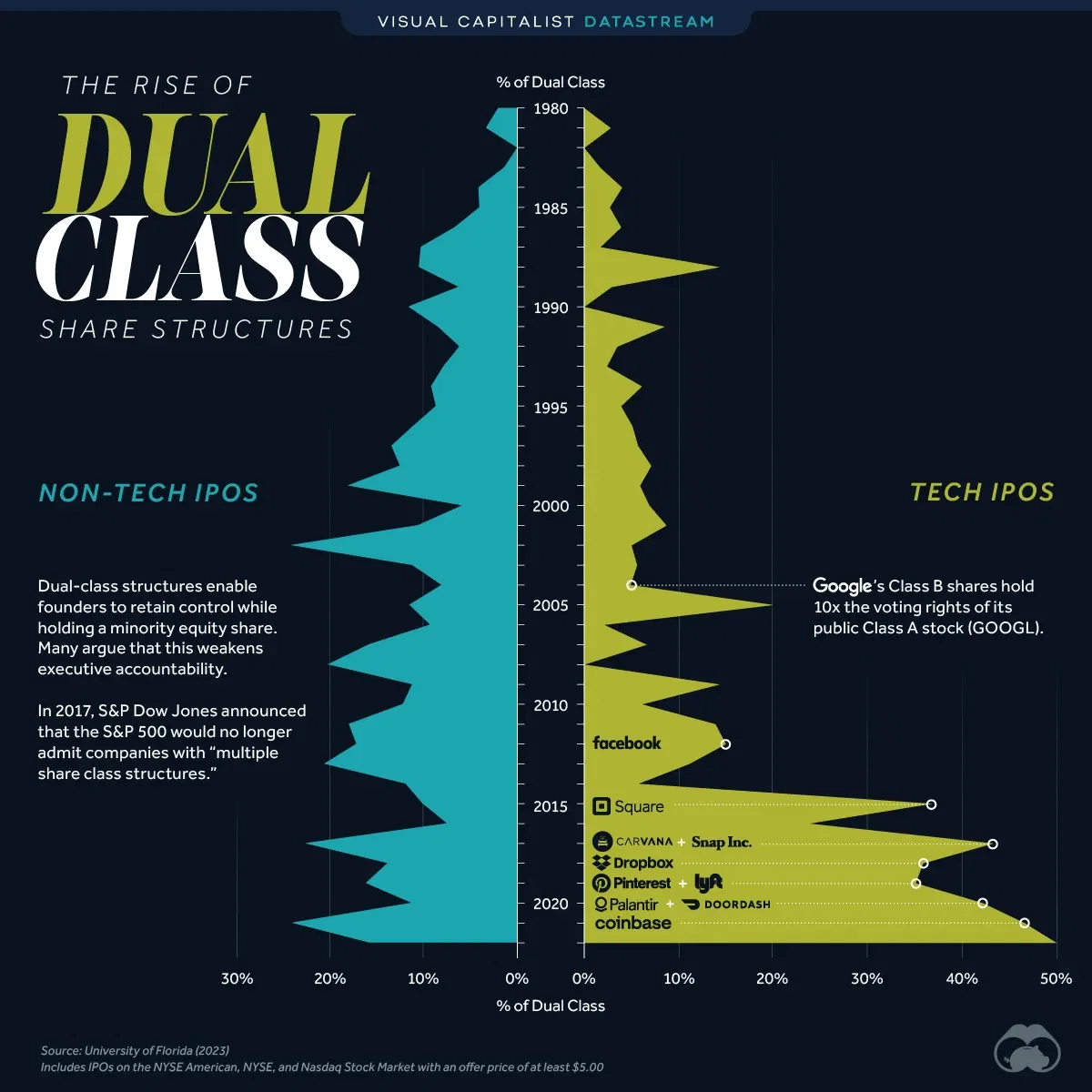

Some companies opt for a dual-class share structure, where one class is offered to the public, and another is reserved for founders and executives. Many argue that this weakens accountability, as executives can simply overrule the wishes of outside investors.

The data in this graphic lists the number of U.S. companies that have IPO’d with a dual-class share structure. The biggest takeaway from this dataset is that dual-class structures have become much more prevalent among U.S. tech firms. Starting in the mid 2010s, this trend includes noteworthy IPOs such as Facebook (2012), Square (2015), Pinterest (2019), and Coinbase (2021).

In the case of Coinbase, a separate class of shares reserved for founders and insiders has 20 times the voting power of regular, publicly available shares. According to Fast Company, this gives insiders 53.5% of the overall votes.

See an expanded version of this article at visualcapitalist.com