Where Data Tells the Story

© Voronoi 2025. All rights reserved.

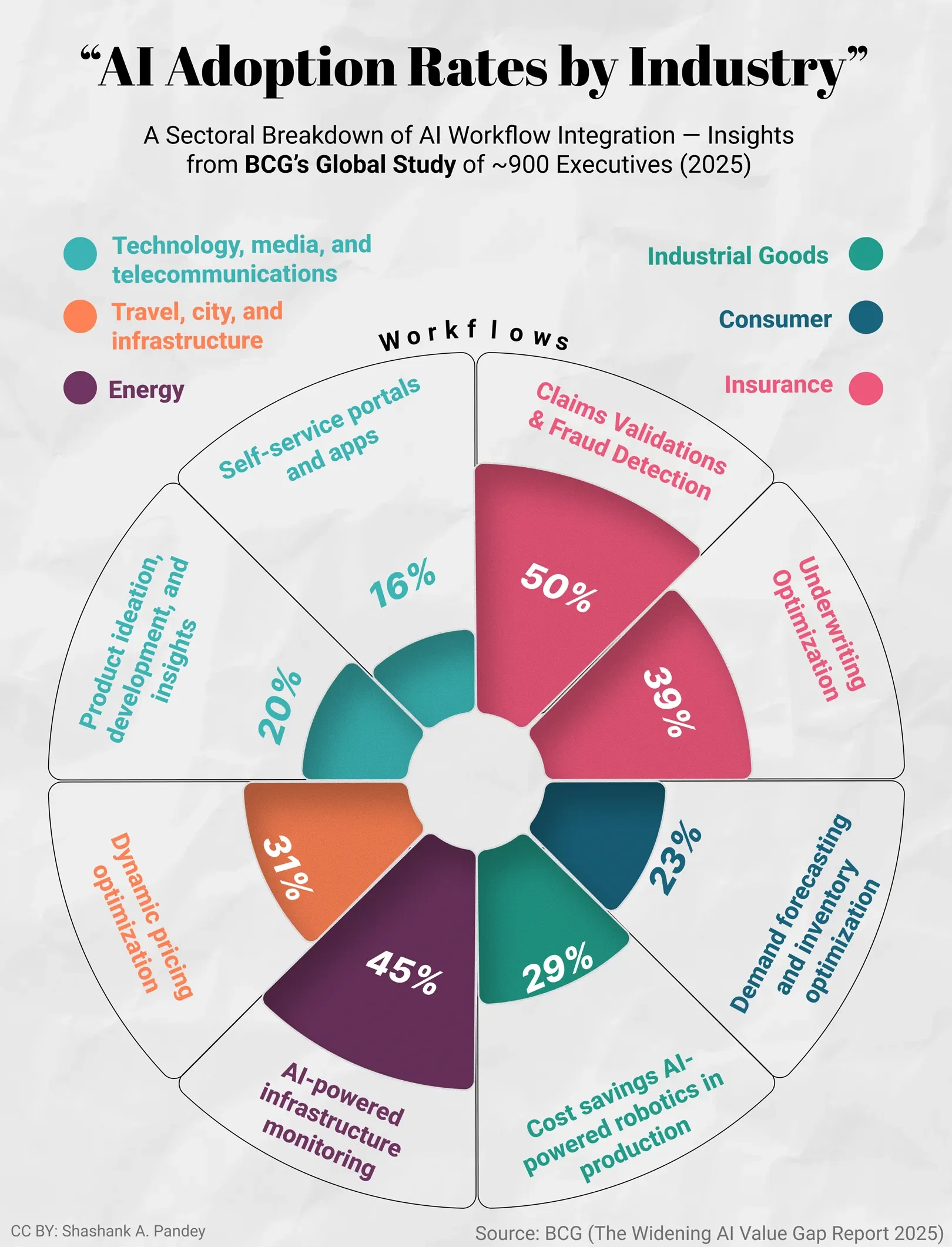

BCG’s Widening AI Value Gap 2025 report offers a decisive message for leaders: AI’s impact is no longer evenly distributed.

Insurance leads the way, with 50% adoption in claims validation and fraud detection, turning high-stakes workflows into AI-powered engines of value.

Energy is scaling AI infrastructure monitoring to avoid addressable costs.

Travel & infrastructure sectors are deploying dynamic pricing to unlock real-time revenue gains.

But here’s the deeper insight:

📊 The data shows that 70% of AI’s potential value is concentrated in core business functions — not in support activities. This underscores that successful AI adoption requires end-to-end workflow transformation, not just the deployment of isolated tools or pilots.

Future-built companies understand this.

🔸 They reinvest early AI gains into new capabilities, widening the value gap every quarter.

🔸 Agentic AI already drives 17% of total AI value, a share expected to nearly double by 2028.

🔸 They focus on high-ROI workflows, scale them decisively, and embed AI deeply into operating models.

For executives, the playbook is clear:

Stop scattering pilots.

Prioritize and transform core workflows.

Scale strategically and lead from the top.

Insurance is already proving what scaled AI execution looks like. The question is: will your sector catch up or be left behind in the widening value gap?