Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Last week, the White House announced funding of $1.5 billion to chipmaker GlobalFoundries, described by The New York Times as the first sizable grant from the 2022 CHIPS Act that is aiming to invigorate research and manufacturing of semiconductors in the United States. At the same time, the newspaper also reported that despite the availability of this financial assistance, two major producers of semiconductors in the U.S. that have based expansion plans around the act have already pushed timelines back. As the global chip shortage of the late pandemic has normalized, companies are not in such a hurry anymore to expand, delaying some critical infrastructure pushes beyond 2024.

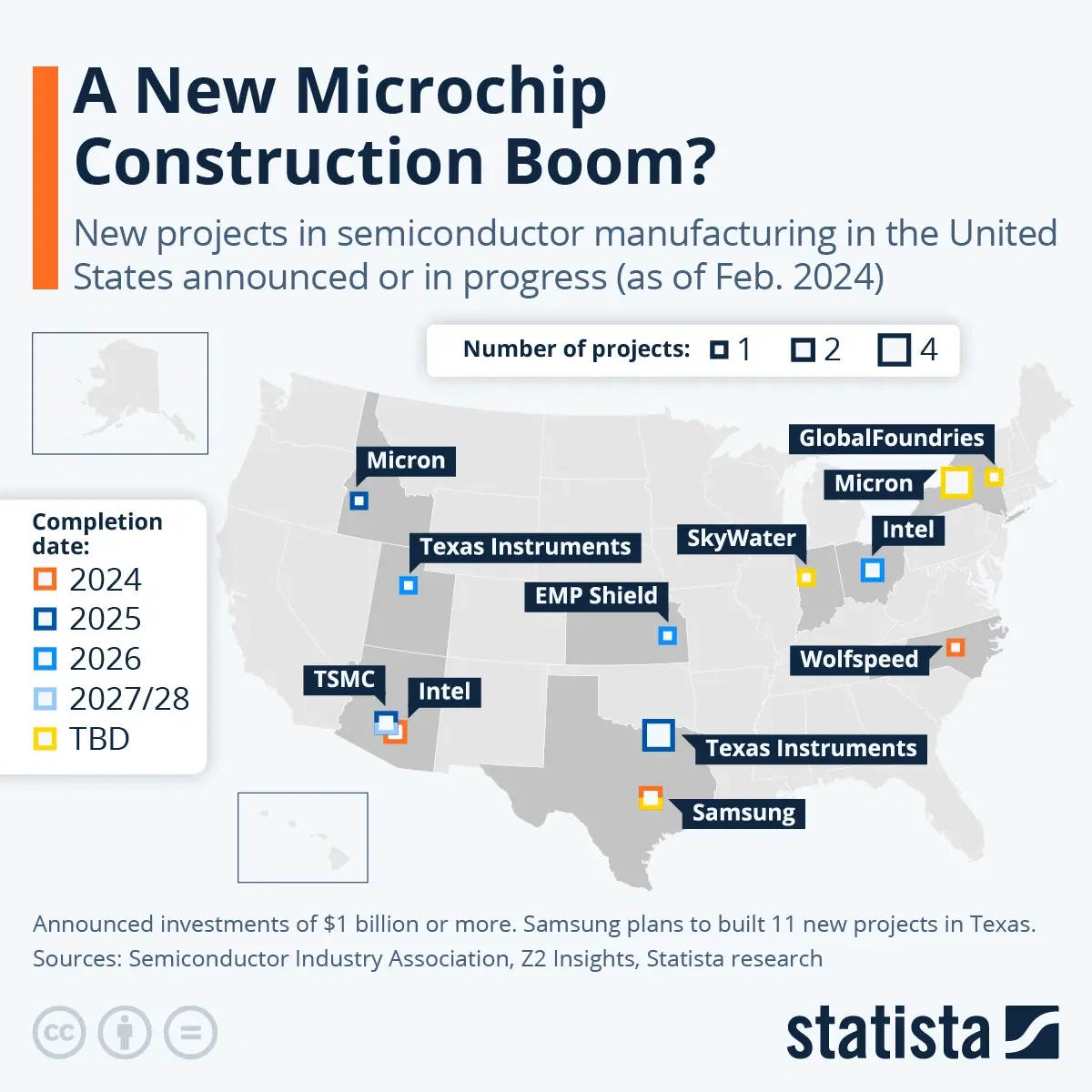

According to the report, industry leader Taiwan Semiconductor Manufacturing Company said in the summer of 2023 that it was opening its first new factory in Arizona in 2025 rather than in 2024 and its second one in 2027 or 2028 rather than 2026. Intel, which is expected to open two integrated factories in the same state this year, meanwhile in early February delayed another opening in Ohio from 2025 to 2026.

A look at the map of major semiconductor manufacturing projects in the U.S. as of early 2024 shows that other than Intel's twin locations near Phoenix, Samsung is scheduled to open a facility on the outskirts of Austin, Texas, this year still. The projects are expected to cost between $17.3 billion and $20 billion and were started in 2021 and early 2022, respectively. The first TSMC factory as well as a facility in Boise, Idaho, by U.S. chipmaker Micron are scheduled to be finished next year. This also applies to four new fabs - wafer fabrication plants - in North Texas by legacy producer Texas Instruments. The company that is also expected to open another location in Utah in two years' time will be producing analog and embedded 300-mm semiconductors at both locations that are used for personal computer and other memory applications.

While the CHIPS Act is not limited to the most advanced types of microchips, cutting-edge logic chips of 5 nm and 3 nm process nodes have been receiving the most press coverage due to their use in new smartphones, laptops and self-driving cars as well as their implications for the technological independence the U.S. is seeking for its future. According to Z2, TSMC and Samsung will be producing chips of this caliber in the United States.