Where Data Tells the Story

© Voronoi 2026. All rights reserved.

Time is an investor’s biggest ally, even if they start with just a modest portfolio.

The reason behind this is compounding interest, of course, thanks to its ability to magnify returns as interest earns interest on itself. With a fortune of $159 billion, Warren Buffett largely credits compound interest as a vital ingredient to his success—describing it like a snowball collecting snow as it rolls down a very long hill.

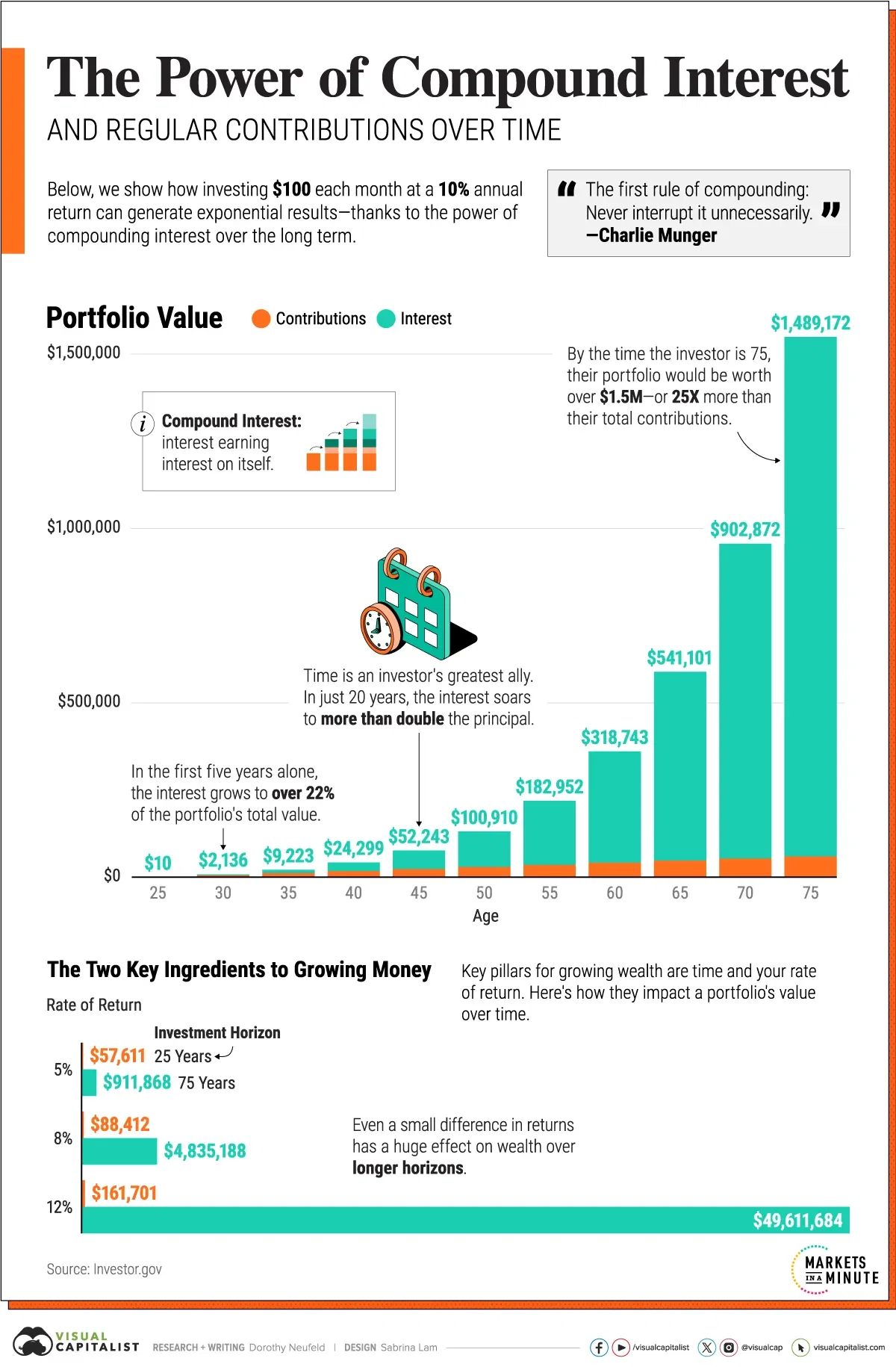

This graphic shows how compound interest can dramatically impact the value of an investor’s portfolio over longer periods of time, based on data from Investor.gov.

The data shows how investing $100 each month, with a 10% annual return starting at the age of 25 can generate outsized returns by simply staying the course.

As we can see, the portfolio grows at a relatively slow pace over the first five years.

But as the portfolio continues to grow, the interest earned begins to exceed the contributions in under 15 years. That’s because interest is earned not only on the total contributions but on the accumulated interest itself. So by the age of 40, the total contributions are valued at $19,300 while the interest earned soars to $24,299.

Not only that, the interest earned soars to double the value of the investor’s contributions over the next five years—reaching $52,243 compared to the $25,300 in principal.

By the time the investor is 75, the power of compound interest becomes even more eye-opening. While the investor’s lifetime contributions totaled $61,300, the interest earned ballooned to 25 times that value, reaching $1,489,172.

In this way, it shows that investing consistently over time can benefit investors who stick it through stock market ups and downs.