Where Data Tells the Story

© Voronoi 2025. All rights reserved.

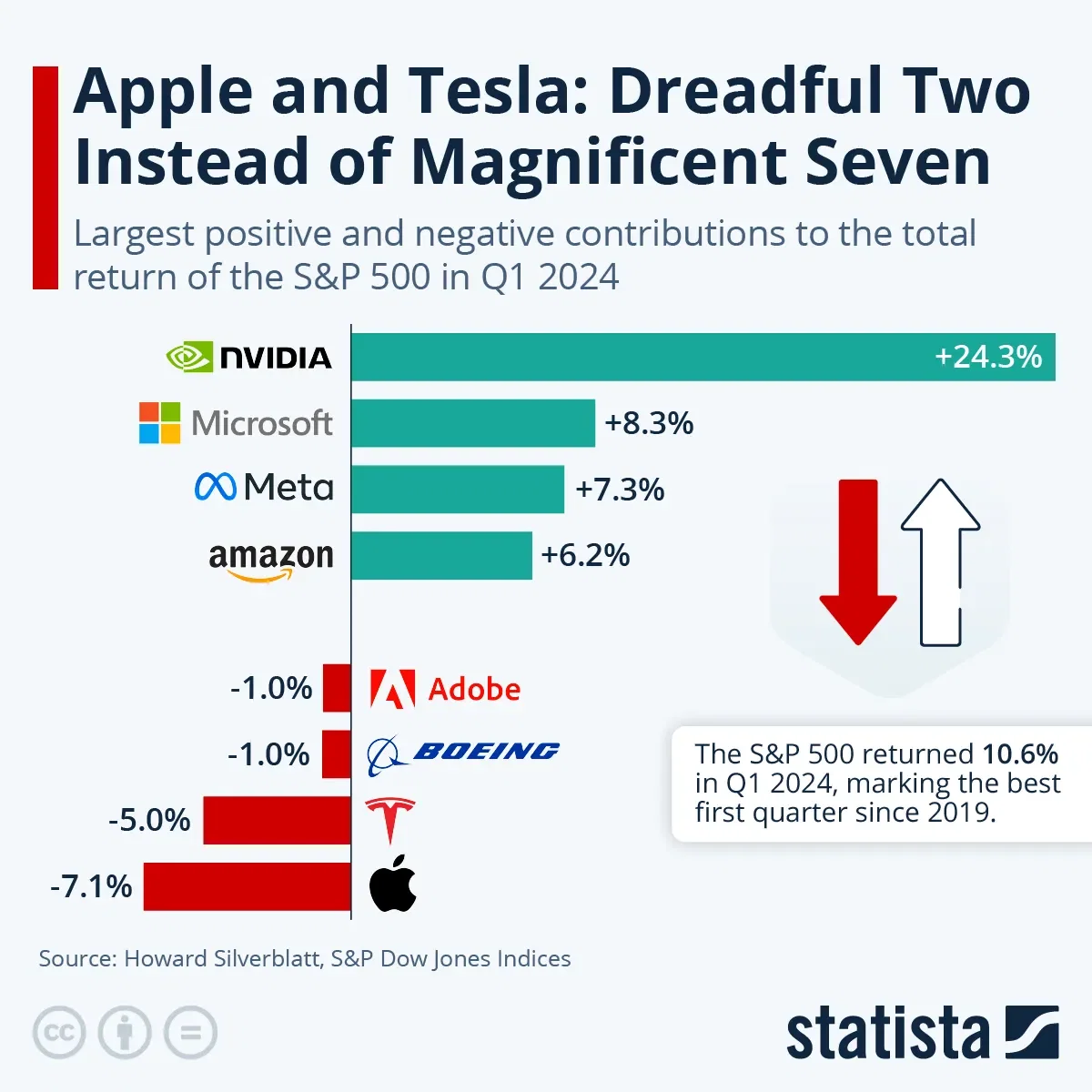

Despite the fact that Wall Street's hopes for a first rate cut in March turned out to be premature, markets were off to a flying start of 2024, as the S&P 500 went from strength to strength, ending the first quarter at yet another all-time high - the 22nd of this year. Overall, the index returned 10.6 percent in the first three months of 2024, marking the best first-quarter performance since 2019. Like last year's rally, the index's latest strength was largely fueled by the excitement surrounding artificial intelligence, as chipmaker Nvidia and Microsoft, a key investor in OpenAI, were the biggest contributors to the S&P 500's overall gains. Meta and Amazon were also among the index's top performers, while two other familiar names found themselves in unfamiliar territory.

Apple and Tesla, both part of the so-called "Magnificent Seven" that rallied through large parts of 2023, had a terrible start to the year, with their respective stock prices dropping 11 and 29 percent in the first quarter. Given their stature in the market-cap-weighted index, the not-so magnificent performance of both Apple and Tesla stood in the way of an even better quarter for the S&P 500, as the "Dreadful Two" dragged the index's return down 1.3 percentage points. While Apple is facing questions over where it's future growth is going to come from in the absence of an obvious "next big thing", Tesla struggles with a slowdown in demand for electric vehicles, growing competition from China and the controversies surrounding Elon Musk, which are reportedly having a negative effect on Tesla's reputation.